are nursing home fees tax deductible in uk

Nursing and retirement home expenses are considered medical. If you are paying the charges for a nursing home you can claim the tax relief whether you are in the nursing home yourself or you.

Your 2020 Guide To Tax Deductions The Motley Fool

You claim tax relief for nursing home fees under the general scheme for tax relief on medical expenses.

. Attendant care costs including those paid to a nursing home can be used as medical expense deductions on your tax return. This means that the portion of your income which is taxable at your highest rate of tax is reduced. You claim tax relief for nursing home fees under the general scheme for tax relief on medical expenses.

If there are any doubts about any of this it might be wise to consult a tax expert I am not one I dabble in the subject and the fees would be deductible. To do so she rents her home out but this is taxable income. In Scotland it is 28750 and in Wales the care and care home fees threshold is 50000.

You can claim this relief at your highest rate of income tax if the nursing home provides 24-hour on-site nursing care. If that individual is in a home primarily for non-medical reasons then only the cost of the actual. So whether moving to a care home equates to having two homes such that your FIL can choose his original house as his main home I am not certain.

If your nursing home expenses are deductible you may qualify for medical reimbursement. Are my mothers nursing home expenses which she pays deductible. To claim these expenses.

A nursing home that provides 24-hour nursing care on site qualifies for this tax relief at the highest income tax rate. If these fees are necessary to be able to fulfill your professional obligations they can be claimed. To qualify for a tax deduction on nursing home fees you need to meet certain criteria on the general scheme.

There is no medical reimbursement for the rest of the nursing home costs including meals and lodging. Are Professional Fees Tax Deductible Uk. Only the portion of your monthly bill used to pay attendant care salaries can be deducted.

June 5 2019 249 PM. Helping business owners for over 15 years. Costs average around 600 a week for a care home place and over 800 a week for a place in a nursing home.

Typically you can deduct nursing home expenses for yourself your dependents or your spouse. You may claim Income Tax IT relief on nursing home expenses paid by you. Nursing home expenses.

The entire 75000 paid to the nursing home is deductible on Roberts 2019 individual tax return as a medical expense subject to the AGI limitation because it is for qualified long-term care services. You need to include a detailed statement of the nursing home costs. Matt Coward at accountant Price Bailey.

When your spouse dependent or yourself were taken into a nursing home for medical reasons the entire price of the home did not need to be deductible. If a single person is forced to go into a care home but because her home is worth 200000 she will receive no support to pay her care home fees. Is Paying For Elderly Care Tax Deductible Uk.

You can claim this relief at your highest rate of income tax if the nursing home provides 24-hour on-site nursing care. Read IRS Publication 503 to learn more about dependent care deductions and who can claim the tax credit in your family. This is a contribution towards the cost of your nursing needs.

Are elder care expenses tax deductible. The maximum amount of tax relief you can claim depends on whether the nursing home is a 24-hour on-site clinic. Home nursing You can claim relief on the cost of employing a qualified.

This depends on why your mother is in a nursing home. Robert qualifies as a chronically ill individual because he is unable to perform at least two ADLs. The IRS offers tax relief for professional membership fees.

If you your spouse or your dependent is in a nursing home primarily for medical care then the entire nursing home cost including meals and lodging is deductible as a medical expense. Yes in certain instances nursing home expenses are deductible medical expenses. Are Nursing Home Fees Tax Deductible.

If it is not for medical. Anyone with capital below these amounts will qualify for some financial support. I have to pay a top-up of 153 a week for my mothers care home feesIs there any way that I can offset this cost against my income tax bill.

As long as it is primarily for medical purposes the cost of nursing care that you receive whether youre visiting your spouse or your dependent is deductible as a medical expense. Research indicates that the average cost of residential care varies drastically depending on where in the UK you live creating a postcode lottery for. If you live in England and Northern Ireland and have assets of more than 23250 you will have to pay the full cost of your care and are referred to as a self-funder.

Medical expenses are deductible under the general scheme for tax relief and nursing home fees are eligible. If you dont qualify for Continuing Healthcare but you need regular nursing care in a care home or nursing home you might be eligible for NHS-funded Nursing Care. Its paid directly to the care home and the amount should be deducted from your bill.

If you your spouse or your dependent is in a nursing home primarily for medical care then the entire nursing home cost including meals and lodging is deductible as a medical expense. You can claim this relief as a deduction from your total income if the nursing home provides 24-hour on-site nursing care. Providing care for a loved.

The savings and assets thresholds in the UK for 202122 are listed below. Regarding the primary question Is home care for the elderly tax-deductible the answer is yes you can receive an elderly care tax credit on your tax return. Tax relief on nursing home fees.

If you are paying the nursing home fees you can get the tax relief whether you are in the nursing home yourself or you are paying for another person to be there. Are nursing home fees tax deductible in UK. If it is for medical reasons then yes the costs are deductible.

Are care home fees deductible. Yes in certain instances nursing home expenses are deductible medical expenses. This is essentially how much money you can have before you have to pay for care home fees.

Subscriptions are charged to approved professional bodies or learned societies if they are relevant to your work. There can be a claim for nursing home expenses that is deductible.

The Mortgage Interest Deduction Center For American Progress

12 Medical Expense Deductions You Can Claim On Tax Day

The Master List Of All Types Of Tax Deductions Infographic Small Business Tax Business Tax Deductions Budgeting Money

Download Our Guide To Understanding Your Insurance Advanced Sleep Medicine Services Inc Health Information Management Medical Social Work Health Insurance

Pin By Brandi Thomas On Skin Care Rodan And Fields Skin Care Fall Essentials

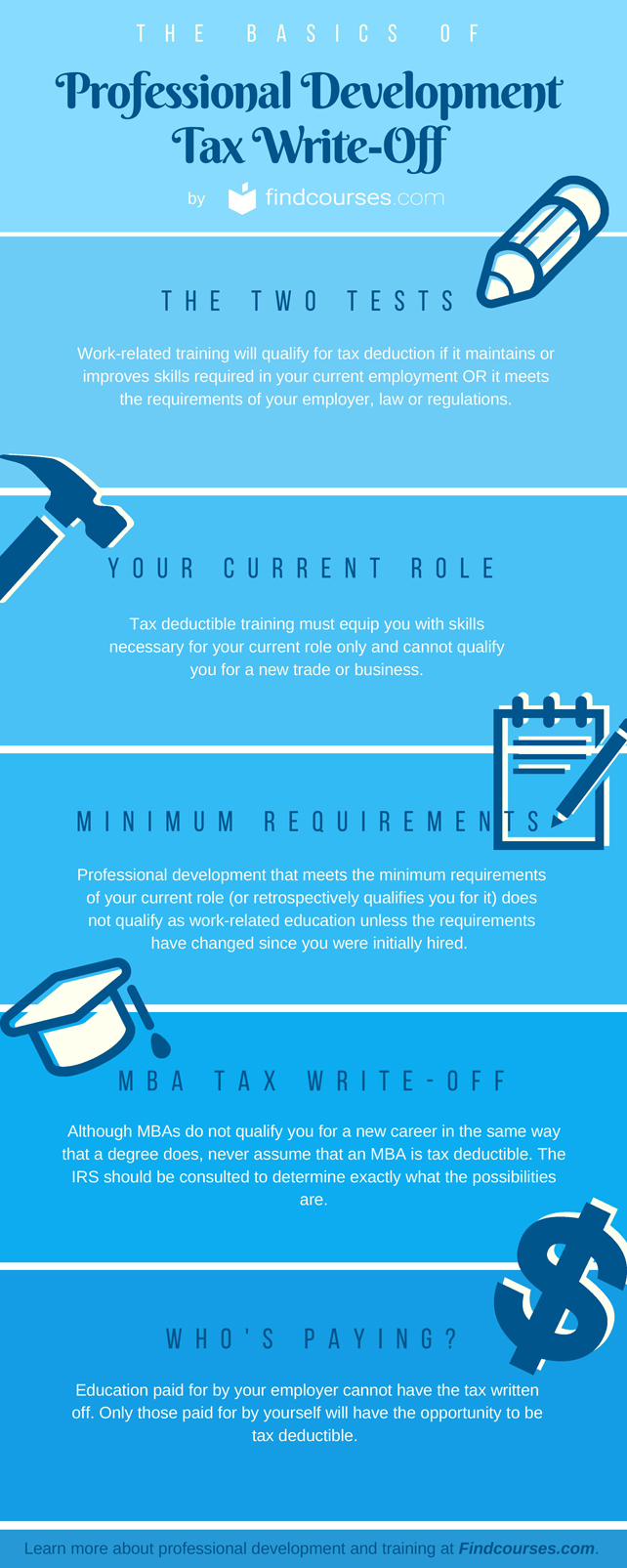

The Professional Development Tax Deduction What You Need To Know

Tax Deductions For Therapists 15 Write Offs You Might Have Missed

Retirement Planning An Infographic How To Plan Retirement Planning Retirement Fund

Are Cobra Payments Deductible For Income Tax Filing Synonym Filing Taxes Income Tax Income

Are Care Home Costs Tax Deductible Uk Ictsd Org

Private Home Care Services May Be Tax Deductible

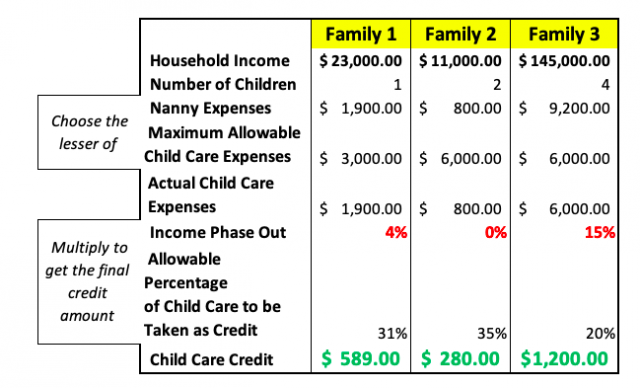

Can I Deduct Nanny Expenses On My Tax Return Taxhub

Pin On Health Insurance Tax Tips To Save

Which Expenditure On Your Website Is Revenue Expense And Which Are Capital Costs Tax Deductions Tax Accountant Revenue

Filing Your Tax Return Don T Forget These Credits Deductions National Globalnews Ca Business Tax Small Business Tax Business Tax Deductions

Irs Tax Forms Infographic Tax Relief Center Irs Taxes Irs Tax Forms Tax Forms

Tax Tips For The Home Based Business If You Re Looking For Tax Deductions And Extra Home Based Business Successful Home Business Nursing School Survival